Latest ACI Dealing Certificate MCQs in Practice Test with Test Engine

Everything you need to prepare and quickly pass the tough certification exams the first time

With Killexams you'll experience:

- Instant downloads allowing you to study as soon as you complete your purchase

- High Success Rate supported by our 99.3% pass rate history

- Free first on the market updates available within 2 weeks of any change to the actual exam

- Latest Sample Question give similar experience as practicing Actual test

- Our customizable testing engine that simulates a real world exam environment

- Secure shopping experience - Your information will never be shared with 3rd parties without your permission

Top Certifications

ACI 3I0-008 : ACI Dealing Certificate ExamExam Dumps Organized by Milburn |

Latest 2021 Updated Syllabus 3I0-008 exam Dumps | Complete Question Bank with actual Questions

Real Questions from New Course of 3I0-008 - Updated Daily - 100% Pass Guarantee

3I0-008 demo Question : Download 100% Free 3I0-008 Dumps PDF and VCE

Exam Number : 3I0-008

Exam Name : ACI Dealing Certificate

Vendor Name : ACI

Update : Click Here to Check Latest Update

Question Bank : Check Questions

Free of charge 3I0-008 braindumps with real questions and Real exam Questions

We have valid and up so far 3I0-008 Exam Questions and PDF Download. killexams.com increases the exact and the most recent 3I0-008 Exam Cram using braindumps which often practically comprise all information you have to pass the particular 3I0-008 exam. With the guidebook of our 3I0-008 exam dumps, you Don't have to possibility your odds on practicing reference ebooks but should just burn by means of 10-20 hrs to memorize our 3I0-008 Exam Cram and answers.

If you go on a tour on internet for 3I0-008 Latest Questions, you will see that a lot of websites are selling outdated Exam Questionsalong with updated labels. This will end up very hazardous if you depend on these cheat sheet. There are several cheap traders on internet that get

zero cost 3I0-008 ELECTRONICO from internet market in minor price. You can expect to waste money when you agreement on that little service charge for 3I0-008 Latest Questions. We always guide applicants to the right direction. Really do not save that little capital and acquire big possibility of failing exam. Just choose authentic as well as valid 3I0-008 Latest Questions giver and get a hold of up to date as well as valid reproduce of 3I0-008 real exams questions. We consent killexams.com as top provider regarding 3I0-008 cheat sheet that will be your lifetime saving decision. It will save from massive amount complications as well as danger regarding choose terrible Exam Questions provider. It will probably provide you honest, approved, appropriate, up to date as well as reliable 3I0-008 Latest Questions designed to really work inside real 3I0-008 exam. The next time, you will not explore internet, you will straight visit killexams.com for your foreseeable future certification courses.

Features of Killexams 3I0-008 Latest Questions

-> 3I0-008 Latest Questions get a hold of Access in a mere 5 minutes.

-> Complete 3I0-008 Questions Loan provider

-> 3I0-008 exam Success Promise

-> Guaranteed Real 3I0-008 exam Questions

-> Most recent and up thus far 3I0-008 Questions and Answers

-> Verified 3I0-008 Answers

-> Down load 3I0-008 exam Files any where

-> Unlimited 3I0-008 VCE exam Simulator Easy access

-> Unlimited 3I0-008 exam Down load

-> Great Vouchers

-> 100% Safeguarded Purchase

-> 100% Confidential.

-> 100% Free Question Bank for check-up

-> No Invisible Cost

-> Zero Monthly Subscription

-> No Auto Renewal

-> 3I0-008 exam Update Appel by Email address

-> Free Tech support team

Discount Coupon on Total 3I0-008 Latest Questions braindumps;

WC2020: 60% Flat Low cost on each exam

PROF17: 10% Further Low cost on Worth Greater as compared with $69

DEAL17: 15% Additional Discount regarding Value Greater than $99

3I0-008 exam Format | 3I0-008 Course Contents | 3I0-008 Course Outline | 3I0-008 exam Syllabus | 3I0-008 exam Objectives

Killexams Review | Reputation | Testimonials | Feedback

How to read for 3I0-008 exam in shortest time?

Killexams. com materials are generally exactly as amazing, and the 3I0-008 exam dumps pack is extremely good, I responded 89% marks using them. I obtained every one of these individuals by planning my exams with killexams. com Questions and Answers and exam Simulator, just like one has not been an permission. I can ensure you the fact that 3I0-008 exam is much trickier than previous exams, thus get ready to have worried.

It is unbelieveable, but 3I0-008 updated dumps are availabe right here.

I am no longer an enthusiast of internet killexams. com, because they are routinely posted by way of flighty people that misdirect us into checking stuff We needn't difficulty with as well as missing items that I undoubtedly need to comprehend. notkillexams. com Questions as well as Answers. Tag heuer offers entirely massive killexams. com that will help me get over 3I0-008 exam preparation. this is actually the way whereby I passed this exam from the next try and have scored 87% marks. thanks

No questions turned into asked that turned into out of these Questions and Answers bank.

I also possessed a very good experience with this preparation set, which usually led myself to pass the 3I0-008 exam along with over 98%. The questions are real and legitimate, and the exam simulator can be a remarkable/instruction machine, although you're no longer planning on taking exam and wish to broaden your personal horizons and also enlarge your personal know-how. I possess given quarry to a acquaintance, who in addition works in such a vicinity although just obtained her CCNA. What I indicate is It is a superb knowledge machine for all and also sundry. And when you plan to consider the 3I0-008 exam, that is the stairway in order to achievement: )

What study guide do I need to pass 3I0-008 exam?

I just necessary to tell you that we have passed in 3I0-008 exam. All of the questions around the exam desk had been by killexams. It is said to be the actual helper for my situation at the 3I0-008 exam counter. All compensate of my favorite fulfillment would go to this guide. It is the real cause regarding my pleasure. It aptly, properly guided my family for wanting 3I0-008 exam questions. Through the help of this research stuff, My partner and i changed into blessed to efforts to all the actual questions with 3I0-008 exam. This test stuff tutorials a person properly and ensures you a hundred% accomplishment from the exam.

What is 3I0-008 dumps exam and study guide price?

My spouse and i passed the exact 3I0-008 exam with this bunch from Killexams. I am confused I would do it while not it! We can see, it ranges a huge range of ideas, and if an individual prepare for the exact exam against your, without a established strategy, probably some things can certainly fall with the cracks. These are generally just a few places killexams. com has allowed me to with there is certainly just excessive info! killexams. com ranges everything, and as they use real exams questions spending the 3I0-008 with a smaller amount stress is easier.

ACI Dealing exam Questions

Measured response: a way to design a european instrument against financial coercion | 3I0-008 Dumps and real questions

A wall of delivery containers in Lyon, FranceJan Buchholtz CC via-NC-ND

A wall of delivery containers in Lyon, FranceJan Buchholtz CC via-NC-ND

It was once the case that the ecu Union had no alternate options available to it when confronted with different global avid gamers’ use of financial coercion towards it. This coercion would gravely violate either European or country wide sovereignty. but, now, Europe has an option accessible to it give a boost to itself against economic coercion. the european commission is presently in the method of designing an anti-coercion instrument (ACI), which might allow Europe to take countermeasures in opposition t third-country coercion and act as a deterrent towards coercive practices (comparable to the alternative of a collective defence instrument that the ecu Council on international family members analysed final 12 months). The commission is set to propose the ACI this autumn as a part of its Open Strategic Autonomy alternate strategy. Member states will then make a decision even if they might like to set up the deterrent.

however what should the ACI appear to be? what's the particular gap in the eu’s defences that it would fill? What forms of financial coercion may set off eu countermeasures? and what kind of countermeasures should it use? How would the ecu come to a decision no matter if to impose them? seriously, might the ecu really ensure that the ACI would give a boost to its position, given the significant risks concerned?

There appears to be an avenue for designing an ACI that might answer these questions, and would ensure the eu grew to be less prone to financial coercion. but it surely is a daunting task. This report proposes a couple of concepts for a way the european can approach this problem. It suggests which concepts might be most possible and valuable. it's in keeping with the work of ECFR’s project drive for Strengthening Europe towards economic Coercion, which brings collectively high-level representatives from six eu member state governments and the inner most sector.

This file is a fabricated from the european Council overseas members of the family’ work and the opinions expressed in it these of the particular person authors. The document presents ideas for the european debate. it's according to a systematic consultation endeavor that engaged with high-degree public and personal actors from the Czech Republic, France, Germany, the Netherlands, Spain, and Sweden. ECFR’s assignment force for Strengthening Europe in opposition t financial Coercion labored on these proposals all over the primary half of 2021. members of the task force discussed several viable responses to economic coercion, and a number of alternate options for an anti-coercion instrument. The paper doesn't mirror a consensus of the assignment drive. The authors of the paper took under consideration how individuals from different backgrounds in the public and personal sectors, and academia, jointly considered the opportunities and challenges of an anti-coercion instrument.

The threatsthese days, Europe may be extra at risk than ever of affected by a big range of economically coercive measures from China and other potent third nations.

China is willing to use financial punishment to exchange ecu policies: In March 2021, Beijing imposed de facto economic sanctions on European businesses to ship a message to the european. After the ecu imposed human rights sanctions on four local chinese officials in coordination with the us, Beijing responded in a wildly uneven style. It directed its action against European ambassadors, parliamentarians, and consider-tankers, however additionally in opposition t European companies akin to H&M and Adidas, which disappeared from chinese language e-commerce apps in the face of so-known as “accepted boycotts”. The latter are an increasingly standard chinese language sanctions tactic. besides the fact that the financial hurt turned into confined, Beijing in particular looked as if it would need to ship a message to Europeans to say: China is now ready to use financial coercion in direct response to European coverage selections – to even average european makes an attempt to adopt better policies and shut ranks with the united states. President Xi Jinping told Chancellor Angela Merkel as tons. in line with Xinhua, Europe turned into “to make [a] relevant judgment independently.”

Beijing commonly refrains from using many of the equipment attainable to it, principally these overseen through its Ministry of Commerce and especially vis-à-vis the ecu. Tying Europe extra into its price chains and making it more stylish on China is still an appealing prospect for Beijing. however, because the US and Europe are closely aligned as soon as once more, and considering that tensions with China are likely to persist, there is a good risk that Beijing will have fewer inhibitions about the use of such measures. The stronger China receives, the more likely and more consequential chinese language financial coercion will turn into. Some Europeans, such because the participants of a possible new German executive containing the eco-friendly celebration, can also are looking to take more difficult stances on chinese language human rights violations. China has shown that this comes with a very good risk of economic punishment, chiefly if the eu is not greater resilient. In recent years, China has proven the coercion it's inclined and capable of use on – as an example –Australia, Germany, the Netherlands, and Canada (see overview).

the united states is lower back as a professional companion and protector of the european. close ties with Washington are fundamental for many factors, no longer least on account of the values that Europe and the united states share. however they're additionally important for Europe to be in a position to tackle economic coercion: joint policies can enhance the ecu’s resilience. And harmony with the U.S. and a lot of different like-minded partners additionally acts as a deterrent to third-nation coercion. on the eu-US summit in June, Europeans and americans underscored that tackling economic coercion with the aid of third nations is a shared transatlantic difficulty. The summit left little doubt that they're on the identical side in this fight. The ecu must proceed to take lively steps, to be capable for compromise, to build returned more suitable in relations with the USA, and to make stronger the suggestions-primarily based overseas order.

however, to enrich transatlantic members of the family, here's no longer sufficient. both the ecu and the us need to keep a couple of things in intellect. The european should remember that Washington can't always assist, and that the us expects the european to cut back its vulnerabilities, including via buying more desirable capabilities for itself. the USA would opt for a resilient Europe over a susceptible one as its companion. on the equal time, the us should remember that Europeans agonize about “the usa First” in cover (Joe Biden’s “buy American” exhortation suggests this has no longer absolutely disappeared) and about unilateral US measures – not least extraterritorial sanctions, which – to lend US overseas policy more desirable effect – privilege coercion of allies or allied corporations over a powerful, jointly agreed transatlantic stance. Such US measures aren't a big difficulty when European and American coverage stances are aligned, or when Washington takes into consideration the ecu’s perspective – as is the case now under Biden. however, if there isn't any coverage alignment sooner or later, there's a chance of the ecu experiencing new measures from the united states. the us will take Europe into account extra if the european makes clear that doing so could be in the usa’s personal pastime – and the closest feasible transatlantic relationship is within the pastimes of each.

Key issues for determination-makersThe ecu should trust the following key aspects as it contemplates a way to establish a brand new anti-coercion instrument.

If third international locations habits financial coercion successfully towards Europeans, it'll have 4 features:

there is a gap within the european’s defences against financial coercion. The ecu has a big range of tools that it might use to look after itself when third nations use economic capability in pursuit of a geopolitical goal. These consist of the usage of dispute agreement mechanism on the World exchange corporation (WTO), vital provisions contained inside bilateral agreements with third international locations, and standard trade defence gadgets. The ecu has additionally currently brought to its armoury an updated exchange enforcement law that permits it to behave in trade concerns despite the fact that – as a result of blockages within the organisation brought about via the Trump administration’s refusal to appoint new individuals to its appellate physique – there is not any ultimate WTO ruling. additionally, the eu put in area an funding screening mechanism to counter strategic takeovers, which grew to be operational in 2020. And the ecu has lately revised export controls relating to human rights and twin-use gadgets.

besides the fact that children, when other powers use financial coercion in opposition t Europeans, their moves are often characterised by using here facets.

alternate as a weapon: economic coercion has a different goal to unfair alternate practices. It seeks to alter executive or company guidelines to the geopolitical or economic competencies of the coercing state or corporation. The WTO struggles with this politicisation of trade and funding: its position is to investigate even if a convention is in keeping with the guidelines of international exchange. however third countries can use financial drive to obtain a unique intention – influencing different countries’ coverage selections on, as an example, telecommunications, energy, human rights, or tax. In such cases, financial coercion could constitute a violation of foreign public law. China punished Australia for calling for a world investigation into the covid-19 pandemic outbreak, as an instance, but the undeniable fact that it aimed to alter Australian policy (and the coverage of different nations by way of implication) isn't taken into consideration in the context of the WTO. in a similar way, the chinese ambassador in Berlin threatened punitive tariffs on German vehicle exports if Germany banned Huawei from building its 5G network. The real challenge in such circumstances isn't even if this classification of measure would have constituted an unfair trade practice, but whether they alter German policies or the protection of the country’s important infrastructure.

Swiftness: If third nations use economic coercion, they can prevent Europeans from enacting their personal guidelines and take agencies hostage long before the WTO finds that they have violated trade law (if the business enterprise does so at all) or before Europeans have the capacity to react. The difficulty is that economic coercion exploits the slowness of any response; besides the fact that the WTO dispute agreement mechanism become functioning appropriately, choice-makers in governments and the inner most sector regularly have a just few days to make a consequential policy choice. by the point a punitive tariff, a sanction, or a favored boycott has been discovered to be unlawful, a executive has already been forced to make a decision the way to construct a 5G community, even if to impose a undeniable tax, or even if to pursue a particular human rights subject. for example, in October 2019, Trump threatened to rapidly cut Europeans off from change with Turkey by imposing extraterritorial sanctions on European agencies, as a means of trying to alternate Turkish president Recep Tayyip Erdogan’s place on Syria. The war in Syria, and European industrial dealings with Turkey, would had been in a extremely distinct place by the point the dispute agreement mechanism discovered that such drastic sanctions allowed for countermeasures. And leaders aside from Trump are also in a position to quickly coercive action: China also moved quickly in opposition t Australia. within the brief time period, European policymakers face a stark alternative within the era of financial coercion: cease taking robust positions on human rights or incur economic charges; encompass Huawei in European 5G networks or settle for job losses; cease definite dealings with a 3rd nation or face punishment. that time body concerns.

working in a gray zone: no longer all cases of financial coercion fall into the class of probably unfair trade practices. China justified its punitive measures towards Australia with apparently ‘legitimate’ anti-dumping and health justifications. Australia already had more anti-dumping measures in location towards China than vice versa, and a WTO evaluate of the condition might also now not favour Australia. There may even be instances through which a 3rd country does indeed have a valid difficulty about dumping – but when that third country imposes anti-dumping measures in retaliation for, or to try to deter, unrelated home or overseas policies, the WTO rulebook could not capture it at all. economic coercion additionally often acts via informal channels, blackmail, or non-trade tools. in simple terms the introduction of uncertainty, or the risk to make use of a punitive financial measure, can assist obtain a 3rd country’s economic coercion purpose. Neither Europe’s defences, nor the european, sufficiently account for the ‘gray zone’ territory during which coercion operates.

generation of ecu divisions: If a 3rd nation employs financial coercion in a wise method, it'll limit the variety of eu member states or economic sectors it makes use of it towards, aiming to go away different Europeans indifferent to what's going on – or even to make some ecu states suppose the coercion is overlapping with their dreams. Turning the entire european or many financial sectors in opposition t the punitive actions would not be within the pastime of the coercer. And, certainly, Europe generally struggles to be resilient when financial coercion divides the european. Third-nation coercers regularly most effective should persuade one or two international locations that European resilience isn't price pursuing in a specific condition. here's why the european would benefit from having an instrument that enables a collective defence approach and isn't elegant on unanimity. this is able to support the eu’s probability of deterring potential perpetrators from attempting to divide Europeans.

Closing the gap: a new instrumentAn ACI may fill the hole in the eu’s defences outlined above. under an ACI (or a collective defence instrument), the ecu could be capable of collectively adopt swift countermeasures to treatment coercive behaviour. Importantly, its leading feature would be to deter offensive movements via others – and by no means to pursue offensive moves of the eu’s personal. it will be a reactive tool, and would handiest be used in accordance with violations of international legislation and in response to international law, when all other alternatives had did not comfy Europe’s resilience. using the instrument can be assessed in opposition t the ecu’s broader aims of strengthening multilateralism and in the context of its bilateral members of the family with a selected nation. it will complement current tools and intention to make diplomacy and multilateralism greater positive and strong.

how it would workThe european would circulate a framework legislation that complemented its existing defences and supplied the european fee with an additional criminal instrument that it could use to reply to financial coercion. It might set up such an instrument beneath the ecu’s average commercial policy (Article 207 of the Treaty on the Functioning of the ecu Union).

the brand new regulation would outline the scope of financial coercion that the ACI might cover, as smartly as the methods by which the european might adopt countermeasures that it had in the past set out.

felony basisthe ecu commission needs to detail the legality of the instrument under foreign legislation in a meticulous means: it should be clear that its method is in response to foreign legislation. The ACI could be explicitly designed to enable the european to correctly respond to financial coercion. as a result of economic coercion frequently employs ‘grey zone’ tools that the european (just like the WTO) struggles to cope with, the ACI can be according to foreign legislations as lex generalis to the WTO’s lex specialis. Public overseas law is complementary to WTO law. Behaviour could be unlawful under broader overseas legislation and could, for this reason, allow countermeasures (for particulars on the feasible legal avenue for this instrument, see ECFR’s outdated document).

comparisonfacing economic coercion, decision-makers in the fee and member states would deserve to evaluate the condition. This contrast could check:

To be triumphant in all this, the european likely needs to have more advantageous capacities of evaluation than it presently has. This raises questions about no matter if a dedicated entity reminiscent of an ecu Resilience workplace – which had state-of-the-artwork analysis equipment, and turned into staffed by way of felony, economic, and geopolitical specialists (as discussed in the ECFR paper referenced above) – can be essential to computer screen expertise coercion. additionally, as issues stand, Europe doesn't supply enough possibilities and incentives for personal-sector actors to share tips about the techniques by which companies face coercion – most specially, casual coercion. groups would now and again want to try this, but they do not at all times are looking to accomplish that directly to resolution-makers in Brussels or European capitals, not least because the eu’s legal guidelines might require them to behave in ways that the third country is making an attempt, via coercion, to discourage.

Key questions for setting up a superior deterrentecu determination-makers want alternate options for imposing countermeasures below an ACI. the following sections focus on the important thing political questions of building this instrument and provide concrete policy alternatives. They consist of:

The choice between these alternate options isn't straightforward, however option 1.5 would provide the appropriate balance between the certainty and suppleness the instrument wants, because of its flexible resilience mechanism. The eu should still be in a position to reply to financial coercion that causes tremendous hurt across groups and sectors, or that is essential to European interests – when member states want to use the ACI. under alternative 1, the ecu could create a deterrent that is simply too inflexible and that may additionally not be useful in new cases the ecu is unable to expect – and that doesn't permit it to have in mind grave forms of economic coercion in opposition t companies. below alternative 2, there's a possibility of presenting powers that are too wide and furthering protectionist hazards.

choice-makers may still tackle board the techniques through which the eu may enforce the options set out above. the following subsections consider this in additional aspect.

alternative 1: A device responding only to predefined coercion that violates a executive’s sovereigntyThe ecu might adopt an ACI that can enact countermeasures to a set of predefined third-nation practices that gravely violate the sovereignty of a member state or several member states.

this fashion, Europe could significantly close the hole in its defences outlined above. it would handiest cover power placed on organizations with the intention of changing their behaviour when a 3rd nation naturally tries to change the sovereign selections of ecu governments at the equal time. where there is not any violation of state sovereignty however there is grave interference with ecu businesses’ guidelines, the ecu would now not be able to use the ACI.

below this choice, the european would define a collection of triggers – third-country measures that, if they violate state sovereignty, could prompt the imposition of countermeasures below the ACI. as an example, it may outline the ACI as covering punitive tariffs and alternate curbs that violate state sovereignty. however Europeans should then add the coercive use of in any other case non-coercive equipment to make certain that the ACI might appropriately cowl the types of coercion that authoritarian regimes comparable to China and Russia have used during the past. this could cover the coercive use of anti-dumping or phytosanitary regulations – which can legitimise using financial restrictions in different cases.

There are a few advantages to this alternative. Addressing grave situations of violations of sovereignty already offers wide scope to the ACI and ensures that it can respond to any coercive measure, financial or now not, that seeks to change european policies. it will likely cover definite extraterritorial measures that gravely violated sovereignty. The instrument would even be simpler to set up – it's more complex to assess the coercive quality of measures that don't goal public authorities than those that are naturally geared toward governments and their guidelines. Limiting using the ACI to predefined triggers would also reassure member states that the ecu might handiest take motion beneath an ACI when such motion occurs. other eu equipment – comparable to a brand new blocking off Statute that addressed no longer simply US sanctions but additionally new chinese language practices no longer lined by means of the ACI – may provide additional insurance plan and even countermeasures (akin to asset seizures) in opposition t kinds of coercion now not coated by the ACI.

youngsters, an ACI designed in this approach would not cowl one of the vital defining dimensions of financial coercion in these days’s globalised economic system, akin to third-nation focused on of inner most businesses to de facto alter their home govt’s policies. The ACI would no longer cover coercion of European governments that did not violate state sovereignty. And, because they didn't signify sufficiently grave or direct interference with public authorities’ movements, the instrument could be unlikely to cover situations of drive such as many regular boycotts and blocks on groups’ compliance with their home nation’s legislations or exports of products to selected markets.

there is a hazard that such an ACI might develop into yet one more ecu instrument that addresses the problems of the past instead of the challenges of the longer term. within the years to come back, Europe’s adversaries – first and highest quality China, however in all probability even Russia – may devise new forms of coercive action that don't seem to be covered by using triggers the ecu defines these days. They may additionally design these primarily to not move the sovereignty threshold that the commission establishes, or to not fall into the class of predefined triggers. in regards to the coercion of companies, the ACI could be essentially the most manageable way to patch a vital vulnerability. As outlined above, it is simply a matter of time before China leverages the centrality of its market lots greater to have an effect on world alternate.

option 2: A device overlaying more forms of financial coercion (instead of a collection of predefined triggers)The ecu might make it viable to set off the ACI based on a variety of coercive measures that are grave but that don't violate member states’ sovereignty directly (or, as a minimum, not gravely). This potential the ecu might use the ACI a little bit more flexibly with a vaguer definition of financial coercion, now not just a set of predefined practices that european choice-makers determine these days. The fee and the Council could jointly establish that a undeniable act is coercive beneath the definition of the ACI and will, hence, set off countermeasures. The ecu may mix anti-coercion motion beneath its blockading Statute – which seeks to block certain extraterritorial sanctions – and under the ACI. this might make it feasible to impose countermeasures in opposition t, as an instance, chinese language extraterritorial measures. A reformed blocking off Statute may trigger countermeasures below the ACI in opposition t such practices under this 2nd alternative.

The leading expertise of this choice is its flexibility and, therefore, credibility. it might be intricate for third nations to design grave coercive measures that the instrument’s definition didn't cover. The ecu would also be sure that the instrument would stay central, in spite of the fact that the character of economic coercion changed into to change. European organizations might quickly be competent where that they had no alternative but to conform to chinese regulations that vastly harmed them, Europe’s exchange, or European coverage. The instrument could be a response to Beijing’s subsequent technology of contraptions – which could leverage China’s expanding centrality in financial networks in techniques not possible today – or to enormous volumes of compelled sensitive facts transfers.

option 2 also comes with challenges. The hazards of protectionism and harm to the guidelines-based mostly order associated with the ACI might become acutely vital for the european below this method. it may well even be hard to show the coercive intent of measures that do not violate member states’ sovereignty. The eu would need to make clear the basis in public international legislations it's basing its countermeasures on – meaning that the instrument can be even more legally advanced.

alternative 1.5: A tool that consists of a flexible resilience mechanismThe eu must make sure that its deterrent has ample scope to supply each flexibility and sure bet. a mixture of alternatives 1 and 2 is viable.

The ACI could define triggers and restrict countermeasures to state sovereignty violations as outlined under choice 1. but it surely could also establish a brand new bendy resilience mechanism that makes it possible for for an ad hoc ACI investigation and perhaps countermeasures when the eu and member states agreed it changed into appropriate – thereby going beyond predefined triggers. The ACI framework legislation or a separate regulation below the eu’s normal business coverage may specify the particulars of this type of mechanism. The technique may still no longer be too prolonged or advanced as, in any other case, the instrument would lose its deterrent impact.

beneath this bendy resilience mechanism, the commission could add specific third-country coercive movements to a law’s annexe via, as an example, an easy delegated act. The Council or the eu Parliament may stop the fee from doing so. The annexe would specify which third-nation coercive moves don't seem to be lined through the ACI’s predefined triggers however which could in spite of this set off the ACI. This may encompass situations where coercive action has had an excellent influence on many companies and sectors, or the place the third country has brought about huge damage to crucial European pursuits. It might additionally encompass instances where state-owned firms have carried out the coercive acts and a third country claims it did not so itself.

The eu would simplest agree with certain acts it brought to the annexe, but would not be obliged to set off the ACI in line with them. The european would then launch the ACI decision-making technique and handiest undertake countermeasures if ecu member states agreed to do so (see section on resolution-making under).

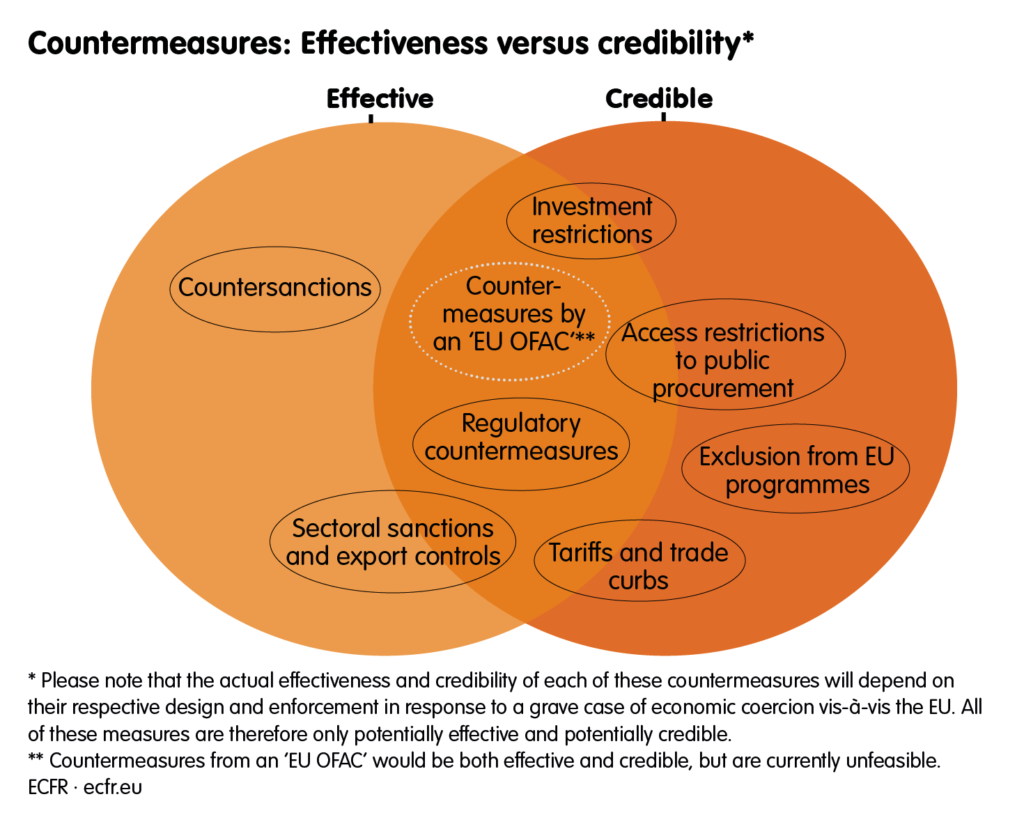

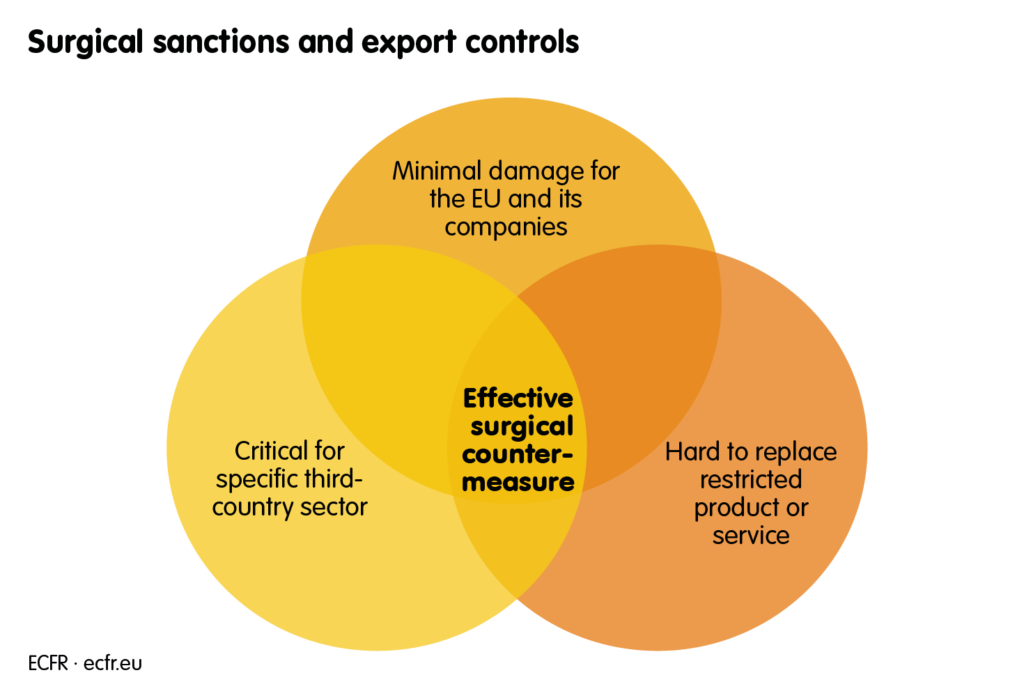

Countermeasures the ecu might impose under the ACIThere are two basic requirements that countermeasures under the ACI deserve to fulfil. in the event that they didn't do so, the hazards of adopting and the use of the instrument may be better than its advantages. The worst direction of motion can be for Europeans to create an instrument that became insufficient to tackling the challenges it turned into intended to tackle. the primary requirement is for the ecu to ensure it has a huge menu of viable countermeasures that it can set up below the ACI. When confronted with a concrete condition of financial coercion, the ecu needs to be able to perform a careful vulnerability evaluation to assist it make a decision which concrete movements to take. it'll need a comprehensive list of countermeasures from which to determine probably the most promising and proportional ones.

The 2nd requirement is for the countermeasures to be both advantageous and credible. The countermeasures should be constructive in the sense that they deserve to have the expertise to affect some thing that an impressive third nation values. otherwise, that country will now not care about the ecu’s countermeasures and should follow through with its economic coercion. And the countermeasures should be credible during this experience that the ecu might swiftly impose them. The european’s existing institutional shape is probably going to restrict the expertise pace of motion – unanimity necessities or the competencies of member states could hurt the credibility of countermeasures.

The instrument may still probably consist of a few key countermeasures. The ACI could fail to satisfy one of the vital two critical requirements if it excluded any of here countermeasures.

The most effective state of affairs for helpful and credible countermeasures under the ACI can be for the european to establish its own version of the united states Treasury’s office of international Asset manage (OFAC). this would be a centralised entity in Brussels that might establish and put in force countermeasures relatively independently. however, as it would contain a switch of member state skills to Brussels by means of treaty trade, it is unfeasible for now.

The ecu’s strange institutional form creates challenges. Europe has to locate countermeasures that approximate OFAC measures’ effectiveness and credibility, however devoid of building a ecu OFAC that might formally centralise sanctions capabilities. on the other hand, the european should are attempting to approximate OFAC as a whole lot as feasible. in spite of everything, imposing tariffs and alternate curbs as countermeasures remain strong alternate options for the eu, which might have amazing credibility thanks to their centralised expertise in Brussels. From a credibility factor of view, change (as part of the normal commercial coverage) is, for this reason, a promising enviornment to look for useful measures. In thought, so is competition policy (the place the ecu commission has substantial advantage).

however, Europe may additionally no longer galvanize a rustic equivalent to China (or even smaller powers) with threats of tariffs or change curbs. one of the crucial leading classes of Trump’s imposition of tariffs on China become that the USA didn't succeed in vastly altering China’s behaviour through such measures. As such, it is uncertain even if an eu tariff or exchange curb would be helpful. this is why the eu must suppose about including countermeasures to the ACI that it doesn't think of as intuitively because it does change measures. In opting for these additional countermeasures, the eu should still delivery with the aid of assessing its bilateral relations with a third nation and that country’s leading strategic as well as short-time period concrete interests in a given sector. One important lever for Europeans might lie in withholding definite types of investments (and know-how transfers) or crucial products that a third nation desired to enter its market (see beneath).

That being pointed out, the european lacks credibility in the sense that, presently, other powers could be not likely to trust that it will truly withhold these items. here's as a result of competencies could sit (partly) with member states, or as a result of Europeans would need to bring together a coalition of the willing to impose countermeasures.

Europeans deserve to make certain they replicate this tension between efficacy and credibility as they design their ACI. They should still think about to the following points of the ACI and the process around it.

InvestigationOpening an investigation into third-country coercive behaviour may enhance the instrument’s deterrent impact devoid of inflicting direct harm. It may well be that, when faced with the penalties of its coercive action, a 3rd country will withdraw its coercive measures. but this only works the place coercion can not obtain its aim instantly and if the ecu appears likely to impose countermeasures.

right here is a list of feasible countermeasures the european could impose, chosen from a lots longer list of theoretical alternate options as a result of these are one of the vital most possible. All of them have benefits and downsides.

Countermeasures category A: Countermeasures which have little prison complexity, as they would curtail advantages the european supplies voluntarily Regulatory countermeasuresThe mere possibility to withdraw an eu equivalence announcement would have a pretty good deterrent impact. Such measures would make the ecu credible, but they may well include too a good deal possibility. Regulatory countermeasures would leverage the energy of the ecu’s market like few different devices. the ecu commission attests equivalence of regulatory regimes in financial capabilities and thereby facilitates the operation of third-nation fiscal institutions in the ecu with the aid of reducing overlapping compliance necessities. Equivalence does not immediately entail a waiver to attain a licence to operate within the eu (apart from in some cases), however taking equivalence fame away from a 3rd nation could be very costly to it. although, such action may instantaneous retaliation, such as the withdrawal of licences for ecu-based mostly banks in third countries. it would also erode the european’s regulatory vigour through overly politicising technical choices, and will harm the european’s credibility as a pioneer of reasonable and transparent regulatory policy.

proscribing entry to the european public procurement marketThis could restrict entry for items, services, and corporations from non-participants of the WTO agreement on government Procurement (GPA) and those countries that do not have imperative free-trade agreements with the european. The GPA doesn't cover China, Russia, or Turkey but does cover the ecu, as neatly as the US and 20 other countries. The european may, for this reason, impose restrictions on public procurement markets without violating its foreign obligations. suggestions about public procurement are also blanketed in a number of of the eu’s free-trade agreements, but this doesn't subject the european’s relations with China, Russia, or Turkey. besides the fact that children, all three have benefited from access to the ecu public procurement market, which is still one of the crucial open in the world. as an instance, within the last ten years, chinese businesses have won €4.5 billion in european public procurement initiatives. The european has probably positive leverage here.

Even for nations that are birthday celebration to the GPA, there may still constantly be room to practice restrictions, given the eu’s ordinary overcompliance with foreign commitments when it comes to the entry it promises international goods, services, and corporations to enter its public procurement market.

The eu is currently working on a world procurement instrument (IPI), which would permit it to add a value-adjustment mechanism to tenders from international locations that discriminate against ecu groups in their personal markets. but a trigger would be different in the ACI, because the european can be responding to economic coercion, no longer to the inability of reciprocity in market opening. nevertheless, for the IPI as for the ACI, public procurement restrictions may be coordinated at the eu degree and initiated via Brussels, besides the fact that the commission would should talk to carefully with member states in doing so. The leading difficulty with this countermeasure is that the ecu has been the use of its leverage ordinarily to inspire others to open up their public procurement markets to Europeans; this should be would becould very well be more durable to achieve if the european started restricting access to its personal market.

Exclusion from european programmesthis might no longer be enough for an exceptional ACI deterrent in lots of instances: it's going to probably most effective be constructive with nations that are likely to depend strongly on participation within the ecu’s analysis programmes, akin to Switzerland, Norway, Israel, and the united kingdom. A dozen countries are at present negotiating association with european analysis programmes. however these include typically the eu’s neighbours and best a small variety of non-European international locations, reminiscent of Canada, Japan, Australia, South Africa, and Brazil. still, the european has effectively used such an instrument in opposition t Switzerland earlier than.

category B: Countermeasures that could be more tricky to put into effect legally as a result of they might most effective be allowed if a third country has really violated foreign legislations. (The european would still deserve to make a felony evaluation on each and every event.) Tariffs and trade curbsbeneath this alternative, the european would impose a retaliatory trade limit, just as it does in exchange defence. This could encompass imposing charges on the cross-border provision of services or blocking alternate in capabilities.

This option’s advantages include: the extensive adventure that the ecu already has in this area; the proven fact that the commission could be performing in a local of centralised competence at the ecu stage; and third international locations’ tendency to take european alternate restrictions severely. however this choice’s leading negative aspects might possibly be that a lot of these alternate measures also impose charges on the eu’s personal economies, and that the european could come to be in a stalemate, with greater tariffs and financial coercion nonetheless in area. There are also important criminal questions that the european would have to make clear: exchange countermeasures could be unlawful in precept beneath WTO law and best authentic as a response to a violation of public international law by using the coercing third state. The violation of public international legislation would have to be clear. The ecu would should choose measures cautiously on a case-with the aid of-case basis.

investment restrictionsWith this choice, the eu could additionally toughen investment provisions and even restrict income reallocation to the home country. The latter act could be an particularly potent and credible measure. but Europeans will deserve to be cautious to comply with the diverse tasks in opposition t certain partners, corresponding to those contained within bilateral agreements on funding. for example, investor-state dispute agreement provisions furnish overseas traders the right to access a world tribunal to resolve funding disputes. The eu additionally depends more on world openness for foreign direct investment than different most important economies. It could lose greater in a tit-for-tat escalation.

Sectoral divestment and export controlsExport controls could be one of the vital strategic and advantageous ways for the ecu to protect itself from financial coercion. The ecu could avoid investments in certain sectors (corresponding to tech transfers to China) or reduce a 3rd country off from a highly specialised product that it cannot effortlessly exchange. Even here, the room for beneficial action is restricted, however there are some sectors through which the eu could have a crucial technological advantage or benefit from a trade asymmetry vis-à-vis a third nation. In these areas, the european might threaten a surgical countermeasure that blocked or curbed exports of a certain product the place this is able to no longer cause tremendous damage to the eu or its corporations, where the central third country could not immediately change the product, and where the product was a key part for (more than a few) crucial economic undertakings.

but the ecu resolution-making process essential to impose this countermeasure can be complex and would weaken the ecu’s credibility. The commission (and its potential european Resilience workplace) would first must launch an investigation into the alleged coercion and conduct a vulnerability evaluation. all the way through the evaluation, the ecu should talk to carefully with member state governments to investigate even if withholding a particular first rate or provider from the coercive third country could be the most advantageous reaction, or at the least part of it. The commission could suggest (in a non-binding remark) the imposition of export controls. Even the commission’s advice to pursue this option would have an preliminary deterrent effect. this is able to then be taken up under the system for amending the record of dual-use items already subject to european export controls the place the Council (via certified majority vote) or the european Parliament may cease it from doing so. however, if they did not, the ecu would add a really selected product as a surgical countermeasure.

This technique doesn't come with out criminal complexities and competencies political boundaries but, with satisfactory coordination, it is usually a particularly beneficial tool for countering coercive measures. And, despite the fact that the technique at the european level fails for some purpose, the close consultation with, and certain recommendation to, member states could, in any case, nonetheless incentivise a smaller community of member states to impose export controls on a country wide stage, as a part of a coalition of the inclined. This might nevertheless be a reputable and highly constructive countermeasure.

Likewise, the identical manner may well be envisaged for proposing sectoral sanctions for divestment. After an preliminary investigation under the ACI, the eu may propose such sanctions to the international affairs council, which might adopt them with the aid of unanimity or the place member states kind a coalition of the willing. That stated, the latter choice would wreck with a key european tradition of adopting sanctions jointly.

Counter-sanctions

Counter-sanctions

In idea, the european already has the vigor to adopt counter-sanctions on third-nation entities according to financial coercion. but doing so would require a big destroy with the european’s sanctions policy culture – namely, that the eu simplest sanctions those liable for an recreation it regards as illicit. Importantly, while this could be a pretty good countermeasure, few would believe that the european would in fact adopt it. Doing so would require a unanimous resolution of the eu’s foreign affairs council. hence, adding countersanctions to the ACI would alternate little.

can charge and compensationSuch eu countermeasures will doubtless impose charges on European entities, even if the alternatives are neatly designed. however the entire point of an ACI is to make it low cost normal for the eu to impose them. nevertheless, countermeasures, together with people who are cross-sector, could have collateral consequences on corporations in sectors or member states that are not concerned by way of the usual third-nation coercion, or where the political mood doesn't accord with the anti-coercion motion taken by way of the fee. The european could agree with providing compensation (fiscal or non-economic) to European financial sectors asymmetrically hit by its countermeasures. since the european would not be able to give anyplace near full compensation for losses, it will focus on these instances that are in particular grave. however simply the symbolism of such percentages would go a protracted means in opposition t fostering the type of ecu harmony that is needed for collective motion in the face of financial coercion by way of different gamers.

The decision-making method for imposing countermeasures The right volume of flexibility for BrusselsThe ACI needs to provide the fee enough flexibility and authority to difficulty alternate and investment countermeasures. ecu member states should have a say within the imposition of countermeasures below the ACI. this is no longer least because the fee could be the use of the ACI to impose countermeasures in keeping with foreign law, now not trade legislations. This means that it could be member states, no longer the fee, that would be obliged to shield the european’s measures before the international court docket of Justice in the event that they had been challenged by a third country.

but if policymakers design a framework that is simply too tight – with the purpose of reducing uncertainty – or in the event that they attempt to specify what the fee can and cannot do in element, the instrument would lose its deterrent effect. The ecu would now not be in a position to make use of it in a swift manner, or would best be able to do so in certain situations, or simplest in a way it is unhelpful in a undeniable situation of coercion that legislators did not foresee after they built the tight framework. To counter third-nation measures, Europeans deserve to profit satisfactory flexibility and remember of their dedication to rules, eu team spirit, and the sure bet of market access that other countries are seeking for.

The ACI will frequently be a device below the european’s regular commercial coverage. Some countermeasures would want a a little distinct determination-making system. but, for many cases, the european can accept as true with the following options for imposing the countermeasures:

set off mechanisms: 4 optionsalternative 1 gives for a qualified majority vote. but, finally, imposing countermeasures beneath an ACI is a particularly political act: member states may still doubtless have more possession and manage over the system – which alternative 3 gives. The draw back of choice three is a probable lack of deterrence if it is uncertain whether the eu would act rapidly if the Council implemented countermeasures. This can be addressed by using choice 2, which still gives for member state possession and manage however offers the commission more flexibility in imposing lighter countermeasures.

choice 1: supply member states a vote in an examination mannerin this association, the commission would propose an imposing act to impose a countermeasure on a coercive country. this might supply member states the possibility to cease the commission with a certified majority vote in the event that they disagreed with the proposed countermeasures or with imposing countermeasures in any respect (because, as an example, they didn't think it become in the european’s pastimes to act in a particular method in a particular circumstance). The fee might then interact with member states and take the imposing act to an attraction committee of better-level member state representatives. If this committee voted in opposition t the enforcing act via a certified majority once more, the commission could not act. in any other case, it may.

option 2: The more difficult the countermeasure, the greater member states’ involvementWith this choice, the ACI framework regulation would provide the fee the chance to impose lighter countermeasures, akin to exclusion from eu programmes or restrictions on european procurement markets, with little involvement of member states. however, for the fee to impose heavier countermeasures, akin to change and investment measures under a undeniable trade quantity, it could must relaxed better agreement from member states. the place the countermeasures proposed are greater extensive, the Council would must set off them.

choice three: Introduce a Council triggerbeneath this arrangement for the ACI, it would be down to the Council to set off the imposition of any countermeasure. The Council would achieve this in line with suggestions from an investigation into the coercive measures imposed on Europeans. This information could come from, as an instance, an european Resilience office. The fee will be the enforcer of the countermeasures, but it would doubtless suggest the countermeasures to the Council – based, as an instance, on the suggestions from the ecu Resilience office. The Council would decide to impose countermeasures by way of qualified majority and, in extremely good circumstances, would benefit implementing powers. This can be justified, given the importance of the instrument and countermeasures. despite the fact, this choice skill the software of measures would be less automated, and could be slower and have less impact as a deterrent.

alternative four: Introduce a fee trigger that member states may ceaseThis arrangement would see the fee circulation to impose countermeasures against economic coercion through an imposing act. The Council would then have ten days to behave should it are looking to cease the measure. If it selected now not to respond, the framework legislation would allow for swift implementation by way of the fee. however the Council could force a vote on what the commission meant to do if requested by way of only 1-third of member states, representing one-third of the eu’s inhabitants. In this type of case, the Council would ought to vote by means of certified majority in favour of the fee’s proposed countermeasures. If it did not, the fee could not implement the countermeasures. If Europeans select this option, they might have to outline a sort of manner for enforcing acts it is diverse from the one currently within the european’s comitology regulation.

The context of international coverageImposing or threatening countermeasures beneath an ACI would have foreign coverage implications. These issues should play a job within the imposition of countermeasures (or any hazard to accomplish that).

The fee is already obliged to habits the usual industrial coverage in this method under the eu’s trade policy, which the ACI would fall beneath. As a fee vice-president, the eu’s excessive consultant would be within the loop on the european’s economic coercion policy. however, this aside, as the institutional actor entrusted to hyperlink the commission with member states, the high representative might play an important role in building the critical political possession of the eu’s economic coercion policy. have been the ecu to accept as true with activating the ACI, it could cause exchanges within the Council by which the high representative’s function as vice-president might prove constructive.

risksThe ACI comes with significant hazards. These are precise, and there is a hazard that the ecu might adopt a new instrument that ends up doing greater hurt than respectable.

Would the ACI harm the multilateral suggestions-primarily based order?at the beginning, the instrument may undermine the multilateral suggestions-based mostly order if Europeans lacked a detailed justification and clarification of the legality of the instrument beneath foreign law. with out a convincing criminal basis, the ACI might quite simply violate overseas legislations. in addition, third countries might try to establish a story that the ecu turned into performing unlawfully however the bloc remained totally dedicated to the WTO device, international law, and the rules-based mostly order.

A hasty reaction from the eu, enacted devoid of ample facts, could damage the credibility of european policy each outside and inside the european should still its actions be perceived as unfair or disproportionate. this would be an personal intention for the eu at precisely the moment when there is new hope for stabilising the world trading system with the brand new US administration and the new head of the WTO.

Would the ACI be too economically expensive?Secondly, the instrument may well be counterproductive if it become poorly designed, both because it would inflict an undesired can charge on eu businesses and economies with out always achieving its aim, or since it would cause a perilous escalation of measures and countermeasures, thereby leaving the eu in an even worse position than it begun in.

If the european imposed certain countermeasures beneath the ACI, this may have a significant financial affect on European alternate and agencies, and there would inevitably be facet-outcomes due to the complexity of global price chains. other trade-defence equipment can also function a warning: some empirical stories have shown that, when the eu protects companies through anti-dumping measures, the ordinary cost for society is greater than four instances larger than the benefit for the sphere in query. in addition, the instrument could have an effect on relations between the ecu and different international locations extra commonly. a third nation might reply to the ecu’s countermeasures with extra coercive measures: China could extra weaponise entry to its marketplace for key European exports; the USA could threaten to withdraw intelligence help in areas where Europeans lacked potential, reminiscent of these the place European privacy legal guidelines make intelligence work extra complicated.

Would the ACI create an ethical hazard?Thirdly, there's a risk that the instrument might create a moral hazard in some situations. for instance, the existence of the instrument might encourage certain companies to take greater dangers, as they might count on that, if they ever received into difficulties, they could draw the whole eu and its market into the war of words. They may be tempted to choose a more hazardous path and undertake techniques that count on such an outcomes, dragging European public authorities into disputes and conflicts that might have been averted in the first area. There is no make sure that this might turn up, however cannot be dominated out. Small and medium-sized agencies should be would becould very well be exceptionally worried that they might pay a disproportionate economic expense for confrontations initiated through greater groups, which are inclined to have better entry to decision-makers.

The challenge of ethical hazard also pertains to a hypothetical compensation mechanism for european agencies, which may be introduced alongside an ACI. it will doubtless now not have an effect on their funding choices extra broadly but, in some cases, it could motivate harmful bets.

Would the ACI motivate protectionism?eventually, there are concerns that the instrument can be hijacked for protectionist applications – or, as a minimum, that it could dangerously shift the european’s center of attention from trade openness to exchange defence. This can be especially true if the instrument was prompted by something that occurs to a private company, and not simply when public authorities in the eu or its member states are ambitions of economic coercion. This could then supply upward push to concerns about equal remedy and non-discrimination.

Mitigation innovationsThe dangers of adopting an ACI are real, however the eu needs to judge them in opposition t the instrument’s benefits and the charges of now not having such a device.

may still the eu opt for the course of inactiveness, this might be not just bad however would also invite further quandary. The route now not taken could motivate Moscow and Beijing to step up their use of economic coercion vis-à-vis the european. They may continue to look such exercise as low-striking fruit: an opportunity that includes little chance but might have top notch rewards.

in a similar fashion, while there are justified concerns about the compatibility of the ACI with the ecu’s WTO commitments and desires, it would be wrong to agree with that the inability of a deterrent would don't have any bad consequences for the WTO. On the contrary, possible already see how the multilateral framework is being undermined – with the trivialisation of the countrywide protection exception, which is used to justify trade restrictions or sanctions, and with controversies concerning recent case legislations (such as the 2019 ruling on Russia and Ukraine) confirming the WTO’s correct to evaluation country wide security claims. The ACI might complement and make stronger the multilateral framework, because it can be utilized in areas where WTO guidelines are beside the point or ineffective – or the place the ecu may prefer to live outdoor the WTO’s remit. All in all, the question here isn't what is harmful and what is now not, but what's much less harmful for the WTO: constructing a brand new device or pretending that the fame quo is best.

To make sure, the european should put mitigation recommendations in vicinity to restrict the dangers of the ACI. These would allow Europeans to minimise the danger that the tool will backfire. nonetheless, Europeans would need to make a decision which of those mitigating strategies are critical: the greater Europeans try to mitigate quite a lot of dangers, the more the instrument may become toothless or advanced.

the way to stay away from harming multilateralismThe foreign guidelines-based mostly order continues to be a cornerstone of public policy throughout the eu. although, Europeans are divided on even if the bloc’s fame as a chief proponent of multilateralism may still keep away from it from constructing an anti-coercion device. If this is a difference between idealists and realists, the latter may respond with the aid of paraphrasing a Latin proverb: in case you want change, put together for change struggle.

Basing the ACI on international public legislation should be sure its legality, thereby empowering the european to use a wide array of measures, together with those involving change. The hazard that others will problem the eu on the WTO is proscribed, as they'd chance setting a precedent for what counts as financial coercion within the first vicinity, which isn't of their pastime. anyway, with an ACI, the ecu might safeguard and support the multilateral framework – just because it would find itself in a much better place to have interaction others on unblocking and reforming the WTO. in this feel, the ACI would have both a strategic and tactical feature.

nonetheless, to mitigate any considerations about legality, the ecu may still consider here facets.

The appropriate type of deterrent would center of attention on imposing a reciprocal countermeasure the place the different facet has an even more desirable interest that it does not want to lose – akin to, as an example, by using exploiting China’s reliance on some abilities transfers from the West. nevertheless, the eu can not rule out the opportunity that its measures would impose some charges for Europeans. Europeans would deserve to be ready to settle for at least some pain. The eu cannot rule out escalation both, but a reputable ACI might additionally deter third-country financial coercion altogether and have a major de-escalation impact.

nonetheless, to mitigate issues about financial prices of the device (and its distributional results, because the harm would hardly be unfold evenly throughout the eu and its member states), the eu should still agree with here aspects.

To mitigate concerns about moral hazard, the european may still believe here aspects.

The purpose of the ACI is to fill a crucial hole within the eu’s defences, now not to become its chief trade policy tool. It is no silver bullet even for responding to financial coercion, however is needed as a part of a broader toolbox. anyway, a reputable deterrent would assist the ecu pursue a change policy concentrated on promoting openness and the guidelines-based order and de-escalation. Blindly relying on free alternate within the face of financial coercion would be little different from letting the policy be hijacked for protectionist purposes. In both case, the european would privilege selected economic hobbies over its broader issues, such as its long-time period protection.

nevertheless, the eu may still best set up an ACI if it will possibly put in region an bold method to mitigate the chance of protectionism. For this, the ecu may still accept as true with here aspects.

The ecu may still be sure that, in contrast to some third countries, it doesn't make a contribution to the politicisation of trade throughout the introduction of more geo-financial equipment. Europeans are dealing with a catch 22 situation: may still they purpose to develop into as professional within the art of weaponised interdependence as other high-quality powers? Or should they keep on with their commitments to free change and the suggestions-based order, trying to establish an international framework instead? Pursuing the latter alternative would allow the european to comprise and neutralise economic coercion – conserving international financial integration.

The european may, of course, are attempting to patch its essential vulnerabilities devoid of adopting an ACI. as an instance, Europeans might install a titanic compensation fund to incentivise agencies to have interaction in trade they would in any other case shy faraway from (out of subject that the eu could be unable to look after their dealings in opposition t third-country coercion). State aid became vital in redirecting Australian businesses’ earnings when chinese language coercion hit them. Europeans might also decide not to fill the hole of their defences if they believed that the charge of submitting to financial coercion is lower than the charge of being able to impose countermeasures, of possible retaliation, and of harm to the foreign exchange gadget through coercion. And it is correct that probably the most vital and potent responses to financial coercion are to build Europe’s own financial electricity and ingenious potential, and to advertise a favorable exchange agenda that eliminates obstacles and diversifies relations.

as the ACI comes with true hazards, the resolution about whether to set up it isn't straightforward. however, if the ecu decides no longer to do so, it will understand that this may chance damaging international guidelines-based alternate during this new era of geo-financial competitors. state of no activity will also be provocative and politicising, too. This path of motion would come with first rate charge, as different world powers would have better means of protecting themselves from economic coercion.

Europe needs to attempt to each turn into extra professional in geo-economic competition and to keep on with its commitment to the rules-primarily based order. this is possible if Europeans assemble no longer an anti-coercion instrument, however a depoliticisation instrument. This could characteristic in just the equal way as this paper has outlined for the ACI. The aim of the ACI should still no longer be to punish third countries; it must be simply reactive. The european should goal to reverse the widespread politicisation of economic interdependence. The instrument would goal to trigger negotiations and talk as a substitute of blackmail – and, for this aim, it would include a clear and swift mechanism for lifting countermeasures once a third country ceased its coercive movements and entered into speak with the ecu. The ACI is usually a mechanism for de-escalation and alter.

A mechanism for the swift elimination of countermeasuresbecause the ecu has experienced in outdated exchange disputes, countermeasures don't effectively cause the resolution of a battle. indeed, they could frequently remain in region for some time – even if each side would want to raise them, as is currently the case in transatlantic family members.

The european may stay away from this with a mechanism that guaranteed the swift removal of countermeasures. The bloc could do so in the following techniques.

mixed with useful and credible countermeasures, but additionally with a transparent depoliticisation mechanism, the brand new instrument can be a magnificent deterrent at the ecu’s disposal.

If Europeans selected to undertake it, their choice would ship a magnificent sign to the realm that the european became determined to defend foreign guidelines – now not simply in rhetoric however additionally by countering coercive practices. Are Europeans ready? we will soon gain knowledge of.

concerning the authorsJonathan Hackenbroich is a policy fellow for financial statecraft and the top of ECFR’s assignment force for Strengthening Europe towards financial Coercion. His work for ECFR’s European vigour programme makes a speciality of financial coercion and geo-economics, and US-China-ecu family members. His publications for ECFR encompass “chinese language sanctions: the way to confront coercion and prevent a squeeze on Europe” and “Defending Europe’s financial Sovereignty: new how you can face up to financial coercion”.

Pawel Zerka is a policy fellow at the European Council on foreign relations. He contributes to ECFR’s Re:form global Europe task, which seeks to increase new innovations for Europeans to be mindful and interact with the altering international order. Zerka is additionally engaged within the analysis of the eu public opinion as a part of ECFR’s unlock initiative, and is a member of the crew exploring easy methods to Boost Europe towards economic coercion. He additionally works on Polish and European overseas coverage.

AcknowledgmentsThe authors need to thank all people that have contributed to our work by sharing guidance, feedback, and information. This relates, in particular, to participants of the ecu Council on overseas family members’ task drive for Strengthening Europe towards economic Coercion. The authors are additionally grateful to all those exterior experts who have mentioned numerous aspects of financial coercion with them during the last six months. They consist of Sebastian Dullien, Alicia García Herrero, Martin Hala, until Patrik Holterhus, Patrick Jacob, Sébastien Jean, Hosuk Lee-Makiyama, Erica Moret, Hanna Norberg, Federico Steinberg, Thomas Verellen, and Anthonius de Vries. inside the ECFR family unit, the authors are appreciative of the advantageous enter of Mark Leonard, Vessela Tcherneva, Jeremy Shapiro, Anthony Dworkin, Susi Dennison, Susanne Baumann, and Andrew Small, all of whom helped sharpen the paper’s argument. Adam Harrison has carried out miracles within the modifying technique, whereas Andreas Bock, Swantje eco-friendly, Amanda Pope, and Marlene Riedel have tolerated our flurries of ideas concerning the graphs, routine, and outreach.

essentially the most vital acknowledgments regularly come closing, and here's the case here: the authors would want to spotlight the crucial contributions of the venture coordinator, Filip Medunic, and analysis assistant Clara Sophie Cramer – and express gratitude for his or her painstaking efforts to verify statistics and meet time limits. despite all these many and numerous forms of enter, the authors remain responsible for the views and any final blunders within the textual content.

the european Council on overseas relations doesn't take collective positions. ECFR publications handiest signify the views of its individual authors.

Subscribe to our weekly e-newsletterwe are able to on no account ship you any content material that is not ECFR connected. we can save your email tackle and your very own facts as precise in our privacy word.

e-mail tackle Subscribe greater on European energy Ambiguous alliance: Neutrality, decide-outs, and European defence

Clara Sophie Cramer, Ulrike Franke (eds.) Essay assortment 28 June 2021

Ambiguous alliance: Neutrality, decide-outs, and European defence

Clara Sophie Cramer, Ulrike Franke (eds.) Essay assortment 28 June 2021

New energies: How the ecu green Deal can retailer the eu’s relationship with Turkey

Asli Aydıntaşbaş, Susi Dennison coverage brief 22 June 2021

Most customary

New energies: How the ecu green Deal can retailer the eu’s relationship with Turkey

Asli Aydıntaşbaş, Susi Dennison coverage brief 22 June 2021

Most customary

Spain-Morocco tensions: How the eu can make progress on Western Sahara

Ana Palacio View from the Council 17 June 2021

Spain-Morocco tensions: How the eu can make progress on Western Sahara

Ana Palacio View from the Council 17 June 2021

This time is different: Spain, Morocco, and weaponised migration

José Ignacio Torreblanca Commentary 26 may also 2021

This time is different: Spain, Morocco, and weaponised migration

José Ignacio Torreblanca Commentary 26 may also 2021

Turkey beyond Erdogan: How the eu dangers letting down Turkish democrats

Kati Piri View from the Council 17 June 2021

Turkey beyond Erdogan: How the eu dangers letting down Turkish democrats

Kati Piri View from the Council 17 June 2021

Council of despair: Iran’s uncompetitive presidential election

Ali Reza Eshraghi Commentary three June 2021

Council of despair: Iran’s uncompetitive presidential election

Ali Reza Eshraghi Commentary three June 2021

Unquestionably it is hard assignment to pick dependable certification questions/answers assets regarding review, reputation and validity since individuals get sham because of picking incorrectly benefit. Killexams.com ensure to serve its customers best to its assets concerning exam dumps update and validity. The vast majority of other's sham report dissension customers come to us for the brain dumps and pass their exams joyfully and effortlessly. We never trade off on our review, reputation and quality on the grounds that killexams review, killexams reputation and killexams customer certainty is imperative to us. Uniquely we deal with killexams.com review, killexams.com reputation, killexams.com sham report objection, killexams.com trust, killexams.com validity, killexams.com report and killexams.com scam. On the off chance that you see any false report posted by our rivals with the name killexams sham report grievance web, killexams.com sham report, killexams.com scam, killexams.com protest or something like this, simply remember there are constantly awful individuals harming reputation of good administrations because of their advantages. There are a huge number of fulfilled clients that pass their exams utilizing killexams.com brain dumps, killexams PDF questions, killexams hone questions, killexams exam simulator. Visit Killexams.com, our specimen questions and test brain dumps, our exam simulator and you will realize that killexams.com is the best brain dumps site.

Is Killexams Legit?